Preferred Security FAQs

- How do I purchase preferred securities?

- What are cumulative and non-cumulative dividends?

- Are preferred securities callable?

- Is the income from preferred securities taxable?

- Where do preferred securities stand in the priority of claims?

- Where can I get a prospectus or prospectus supplement?

HOW DO I PURCHASE PREFERRED SECURITIES?

After syndication, most public preferred securities are traded on an exchange. The most widely used is the New York Stock Exchange. They also trade over-the-counter through broker-dealers who make markets in various preferreds. Privately-placed preferreds trade through a broker-dealer or directly between investors.

WHAT ARE CUMULATIVE AND NON-CUMULATIVE DIVIDENDS?

Preferred stock dividends are either cumulative or non-cumulative. Cumulative dividends are due to shareholders irrespective of an issuer’s profitability. If an issuer has trouble meeting its financial obligations and does not pay a cumulative dividend, dividends accrue and the company is obligated to pay all past and currently due preferred dividends before paying common dividends. If a company does not pay a non-cumulative dividend, it is not obligated to do so in the future. Non-cumulative dividends do not accrue beyond one year and the issuer is still permitted to pay common dividends the year following an omission if preferred payments recommence. In either case, a company is not automatically considered in default if it misses a payment as it would be by missing a bond payment.

ARE PREFERRED SECURITIES CALLABLE?

Preferred securities may be callable, in which case the issuer has the right to purchase the securities from the investor at a predetermined date and price.

IS THE INCOME FROM PREFERRED SECURITIES TAXABLE?

Income from preferreds with the exception of Trust Preferreds is taxable as ordinary income unless it is Qualified Dividend Income (QDI) and/or Dividend Received Deduction (DRD) eligible. QDI and DRD eligibility depends on factors relating to the structure, issuer and investor.

Income from Trust Preferreds and Baby Bonds is considered interest and taxable as ordinary income.

The tax treatment of preferred securities varies. However, investors should not rely on these taxation provisions, as they may change. Incapital does not provide tax or financial advice. Please read the tax section of the prospectus and prospectus supplement and consult a qualified tax professional before investing.

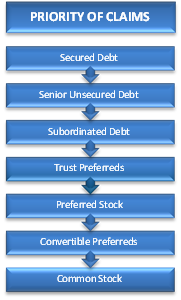

WHERE DO PREFERRED SECURITIES STAND IN THE PRIORITY OF CLAIMS?

The priority of claims refers to the order in which investors receive their share of a firm’s net worth upon liquidation. Preferred securities rank junior to bonds and senior to common stock in the priority of claims against a company’s assets in the event of bankruptcy or reorganization. The diagram below illustrates the capital structure priority. A preferred’s place may vary depending on its specific characteristics outlined in the prospectus and prospectus supplement.

This Priority of Claims diagram is for illustrative purposes only. Each security’s offering documents will govern the issue’s priority.

WHERE CAN I GET A PROSPECTUS OR PROSPECTUS SUPPLEMENT?

The prospectus and prospectus supplement for public offerings are available on the SEC’s website.