Infamous estate fights

By Andrew Osterland

Investment News

September 11, 2011

You don't have to be a celebrity to make a famous mess of your estate planning, but it might help, according to Danielle and Andrew Mayoras, estate-planning attorneys from Troy, Mich.

They use well-publicized battles over the estates of famous people to illustrate why regular people need sound estate planning. Several famous cases are detailed on their website TrialAndHeirs.com.

“Even when there's not a lot of money involved, people fight over it, particularly in this economy,” Ms. Mayoras said.

The following estate cases provide good examples of what not to do:

Former entertainer and California congressman Sonny Bono, who died in a skiing accident in 1998 at 62, didn't have a will. His estate is still being contested in court by, among others, former wife Cher.

Lesson: Don't put it off.

Retired Supreme Court Chief Justice Warren Burger may have been a great legal mind, but he wasn't an estate attorney. He prepared his own will and cost his heirs huge sums in court expenses and taxes.

Lesson: Don't do it yourself.

James Brown, the Godfather of Soul, wanted to leave most of his estate to charity, but he never updated his will, which is being contested by the mother of one of his children.

Lesson: Update your estate plan for life-changing events — even the purchase or sale of a business.

Zsa Zsa Gabor, the ailing 94-year-old celebrity may have another child, if her ninth husband has his way. Prince Frederic von Anhalt, who has power of attorney for his wife, allegedly wants to arrange for an egg donor, a surrogate mother and artificial insemination to allow it.

Ms. Gabor's only daughter, Francesca Hilton, alleges that the prince has been spending her mother's money unwisely.

Lesson: Choose the right person to have power of attorney for you.

What You Will Find Here

- OJOS11

- Articles and news of general interest about investing, saving, personal finance, retirement, insurance, saving on taxes, college funding, financial literacy, estate planning, consumer education, long term care, financial services, help for seniors and business owners.

READING LIST

-

▼

2011

(56)

-

▼

September

(9)

- Estate Planning Blunders of the Stars (Investment ...

- emerging markets: CIVETS and BRICS (wsj)

- Combat Inflation with Floating Rate Securities (F...

- Potential for Countrywide Default (Bloomberg)

- Top 10 Investment Scams (NASAA.org)

- The GAO Report on Immediate Annuities

- The Best and the Worst States for Muni Bonds (Barr...

- What College Degrees Will Get You A GOOD Job? What...

- Nine Most Common IRA Mistakes (the Dolans)

-

▼

September

(9)

Blog List

-

-

Biden’s New Carbon Capture Mandates Will Cause Blackouts, Increases Prices - The lie of the day is from the EPA: Carbon capture will pay for itself (thanks to IRA subsidies). No, it won't even with subsidies. Expect blackouts and a ...

-

China Is Buying Gold, Sending Prices to Record Highs - The global price of gold has reached its highest levels as Chinese investors and consumers, wary of real estate and stocks, buy the metal at a record pace.

-

Jack Dorsey has entered the epic rap beef between Kendrick Lamar and Drake - Twitter and Block cofounder Jack Dorsey appears to be on Kendrick Lamar's side in rap's latest brawl against Drake. Here's a bit of their history.

-

Everybody Else Is Reading This - Snowflakes That Stay On My Nose And Eyelashes Above The Law Trump’s New Birth Control […]

-

Maximizing Employer Stock Options - Oct 29 – On this edition of Lifetime Income, Paul Horn and Chris Preitauer discuss the benefits of employee stock options and how to best benefit from th...

-

Wayfair Needs to Prove This Isn't as Good as It Gets - Earnings were encouraging, but questions remain about the online retailer's long-term viability.

-

Hannity Promises To Expose CNN & NBC News In "EpicFail" - *"Tick tock."* In a mysterious tweet yesterday evening to his *3.19 million followers,* Fox News' Sean Hannity offered a preview of what is to come from ...

-

Don’t Forget These Important Retirement Deadlines - *Now that fall is in full swing, be sure to mark your calendar for steps that can help boost your tax-advantage retirement savings.*

emerging markets: CIVETS and BRICS (wsj)

Monday, September 19, 2011

The Wall Street Journal Wealth Adviser

By JOHN GREENWOOD

Ten years after Brazil, Russia, India and China were dubbed the BRICs, any early mover advantage for investing in those economies has long gone.

.But lovers of acronyms will be relieved to learn the latest investment theme claiming to steal a march on emerging markets also has a catchy name: CIVETS.

The so-called CIVETS group of countries—Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa—are being touted as the next generation of tiger economies, even if they are named after a more shy and retiring feline mammal.

These nations all have large, young populations with an average age of 27. This, or so the theory goes, means these countries will benefit from fast-rising domestic consumption. They also are all fast-growing, relatively diverse economies, meaning they shouldn't be as heavily dependent on external demand as the BRICs.

HSBC Global Asset Management launched the first fund specifically targeting these countries, the HSBC GIF CIVETS fund, in May. HSBC points to rising levels of foreign direct investment across the grouping, low levels of public debt—except for Turkey—and sovereign credit ratings moving toward investment grade.

Critics say CIVETS countries have nothing in common beyond their youthful populations. Furthermore, they say, liquidity and corporate governance are patchy and political risk remains a factor, particularly in Egypt.

"This sounds like a gimmick to me," says Darius McDermott, managing director at Chelsea Financial Services. "What does Egypt have in common with Vietnam? At least the BRIC countries were the four biggest emerging economies, so there was some rationale for grouping them together. A general emerging-markets fund would be a less risky way to get similar exposure."

Still, early numbers suggest that CIVETS investors could prosper. The S&P CIVETS 60 index, established in 2007, is ahead of two other emerging-markets indexes—the S&P BRIC 40 and S&P Emerging BMI—over one and three years.

Colombia: Colombia is emerging as an attractive destination for investors. Improved security measures have led to a 90% decline in kidnappings and a 46% drop in the murder rate over the past decade, which has helped per-capita gross domestic product double since 2002. Colombia's sovereign debt was promoted to investment grade by all three ratings agencies this year.

Colombia has substantial oil, coal and natural-gas deposits. Foreign direct investment totaled $6.8 billion in 2010, with the U.S. its principal partner.

HSBC Global Asset Management likes Bancolombia SA, the country's largest private bank, which has posted a return on equity of more than 19% for each of the last eight years.

Indonesia: The world's fourth-most populous nation, Indonesia weathered the global financial crisis better than most, helped by its massive domestic consumption market. After growing 4.5% in 2009, it rebounded above the 6% mark last year and is predicted to stay there for the next few years. Its sovereign debt rating has risen to one notch below investment grade in the last year.

Although Indonesia has the lowest unit labor costs in the Asia-Pacific region and a government ambitious to make the nation a manufacturing hub, corruption is a problem.

Some fund managers see exposure best achieved through local subsidiaries of multinationals. Andy Brown, investment manager at Aberdeen Asset Management, holds PT Astra International, an auto conglomerate that is majority-owned by Jardine Matheson Group.

Vietnam: Vietnam has been one of the fastest-growing economies in the world for the past 20 years, with the World Bank projecting 6% growth this year rising to 7.2% in 2013. Its proximity to China has led some analysts to describe it as a potential new manufacturing hub.

But communist Vietnam only became a member of the World Trade Organization in 2007. "The reality is that investing in Vietnam is still a very laborious process," Mr. Brown says.

Cynics suggest Vietnam is included within the CIVETS to make the acronym work. The HSBC fund has only a 1.5% target allocation to the country.

Egypt: Revolution may have put the brakes on the Egyptian economy—the World Bank is predicting growth of just 1% this year, compared with 5.2% last year—but analysts expect it to regain its growth trajectory when political stability returns.

Egypt's many assets include fast-growing ports on the Mediterranean and Red Sea linked by the Suez Canal and its vast untapped natural-gas resources.

Egypt has a big, young population—82 million strong and with a median age of 25. Aberdeen says National Société Générale Bank (NSGB), a subsidiary of Société Générale SA, is well-positioned to take advantage of Egypt's underdeveloped domestic consumption.

Turkey: Located between Europe and major energy producers in the Middle East, Caspian Sea and Russia, Turkey has major natural-gas pipeline projects that make it an important energy corridor between Europe and Central Asia.

"Turkey is a dynamic economy that has trading links with the European Union but without the constraints of the euro-zone or EU membership," says Phil Poole of HSBC Global Asset Management.

The World Bank is predicting growth of 6.1% this year, falling back to 5.3% in 2013.

Mr. Poole rates national air carrier Türk Hava Yollari as a good investment, while Mr. Brown prefers fast-growing retailer BIM Birlesik Magazalar A.S. and Anadolu Group, which owns brewer Efes Beer Group.

South Africa: Rising commodity prices, renewed demand in its automotive and chemical industries and spending on the World Cup have helped South Africa—a diversified economy rich in resources such as gold and platinum—resume growth after it slipped into recession during the global economic downturn.

Many see the nation as a gateway to investment into the rest of Africa.

HSBC sees long-term growth potential in mining, energy and chemical firm Sasol Ltd.

Mr. Greenwood is a personal-finance writer in London. He can be reached at reports@wsj.com.

Copyright 2011 Dow Jones & Company, Inc. All Rights Reserved

The Wall Street Journal Wealth Adviser

By JOHN GREENWOOD

Ten years after Brazil, Russia, India and China were dubbed the BRICs, any early mover advantage for investing in those economies has long gone.

.But lovers of acronyms will be relieved to learn the latest investment theme claiming to steal a march on emerging markets also has a catchy name: CIVETS.

The so-called CIVETS group of countries—Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa—are being touted as the next generation of tiger economies, even if they are named after a more shy and retiring feline mammal.

These nations all have large, young populations with an average age of 27. This, or so the theory goes, means these countries will benefit from fast-rising domestic consumption. They also are all fast-growing, relatively diverse economies, meaning they shouldn't be as heavily dependent on external demand as the BRICs.

HSBC Global Asset Management launched the first fund specifically targeting these countries, the HSBC GIF CIVETS fund, in May. HSBC points to rising levels of foreign direct investment across the grouping, low levels of public debt—except for Turkey—and sovereign credit ratings moving toward investment grade.

Critics say CIVETS countries have nothing in common beyond their youthful populations. Furthermore, they say, liquidity and corporate governance are patchy and political risk remains a factor, particularly in Egypt.

"This sounds like a gimmick to me," says Darius McDermott, managing director at Chelsea Financial Services. "What does Egypt have in common with Vietnam? At least the BRIC countries were the four biggest emerging economies, so there was some rationale for grouping them together. A general emerging-markets fund would be a less risky way to get similar exposure."

Still, early numbers suggest that CIVETS investors could prosper. The S&P CIVETS 60 index, established in 2007, is ahead of two other emerging-markets indexes—the S&P BRIC 40 and S&P Emerging BMI—over one and three years.

Colombia: Colombia is emerging as an attractive destination for investors. Improved security measures have led to a 90% decline in kidnappings and a 46% drop in the murder rate over the past decade, which has helped per-capita gross domestic product double since 2002. Colombia's sovereign debt was promoted to investment grade by all three ratings agencies this year.

Colombia has substantial oil, coal and natural-gas deposits. Foreign direct investment totaled $6.8 billion in 2010, with the U.S. its principal partner.

HSBC Global Asset Management likes Bancolombia SA, the country's largest private bank, which has posted a return on equity of more than 19% for each of the last eight years.

Indonesia: The world's fourth-most populous nation, Indonesia weathered the global financial crisis better than most, helped by its massive domestic consumption market. After growing 4.5% in 2009, it rebounded above the 6% mark last year and is predicted to stay there for the next few years. Its sovereign debt rating has risen to one notch below investment grade in the last year.

Although Indonesia has the lowest unit labor costs in the Asia-Pacific region and a government ambitious to make the nation a manufacturing hub, corruption is a problem.

Some fund managers see exposure best achieved through local subsidiaries of multinationals. Andy Brown, investment manager at Aberdeen Asset Management, holds PT Astra International, an auto conglomerate that is majority-owned by Jardine Matheson Group.

Vietnam: Vietnam has been one of the fastest-growing economies in the world for the past 20 years, with the World Bank projecting 6% growth this year rising to 7.2% in 2013. Its proximity to China has led some analysts to describe it as a potential new manufacturing hub.

But communist Vietnam only became a member of the World Trade Organization in 2007. "The reality is that investing in Vietnam is still a very laborious process," Mr. Brown says.

Cynics suggest Vietnam is included within the CIVETS to make the acronym work. The HSBC fund has only a 1.5% target allocation to the country.

Egypt: Revolution may have put the brakes on the Egyptian economy—the World Bank is predicting growth of just 1% this year, compared with 5.2% last year—but analysts expect it to regain its growth trajectory when political stability returns.

Egypt's many assets include fast-growing ports on the Mediterranean and Red Sea linked by the Suez Canal and its vast untapped natural-gas resources.

Egypt has a big, young population—82 million strong and with a median age of 25. Aberdeen says National Société Générale Bank (NSGB), a subsidiary of Société Générale SA, is well-positioned to take advantage of Egypt's underdeveloped domestic consumption.

Turkey: Located between Europe and major energy producers in the Middle East, Caspian Sea and Russia, Turkey has major natural-gas pipeline projects that make it an important energy corridor between Europe and Central Asia.

"Turkey is a dynamic economy that has trading links with the European Union but without the constraints of the euro-zone or EU membership," says Phil Poole of HSBC Global Asset Management.

The World Bank is predicting growth of 6.1% this year, falling back to 5.3% in 2013.

Mr. Poole rates national air carrier Türk Hava Yollari as a good investment, while Mr. Brown prefers fast-growing retailer BIM Birlesik Magazalar A.S. and Anadolu Group, which owns brewer Efes Beer Group.

South Africa: Rising commodity prices, renewed demand in its automotive and chemical industries and spending on the World Cup have helped South Africa—a diversified economy rich in resources such as gold and platinum—resume growth after it slipped into recession during the global economic downturn.

Many see the nation as a gateway to investment into the rest of Africa.

HSBC sees long-term growth potential in mining, energy and chemical firm Sasol Ltd.

Mr. Greenwood is a personal-finance writer in London. He can be reached at reports@wsj.com.

Copyright 2011 Dow Jones & Company, Inc. All Rights Reserved

Combat Inflation with Floating Rate Securities (Forbes)

Fixed-Income Watch

Inflation Protection For Free

Richard Lehmann, 09.12.11, 6:00 PM ET

I have been pounding the table warning about rising interest rates for some time now. Well, it hasn't happened yet, and the latest Fed pronouncement makes it clear that short- and long-term rates will likely stay low for the next two years. My fear of rising rates caused me to recommend adjustable-rate securities. I was wrong on inflation, but my floating-rate picks have done quite well.

Since 2009 the adjustable-rate securities have enjoyed a spectacular resurgence, because most of them were issued by banks and other financial institutions that suffered huge declines during the financial crisis. These "too big to fail" institutions needed capital, and they issued all kinds of paper to bolster their books.

While fixed-rate issues experienced a similar rise, they are hurt by their call provisions. Specifically, most of the issues with a 5% or higher coupon rate are likely to be refinanced. This means they're trading on a yield-to-call basis with measly returns measured in basis points rather than percentages (100 basis points equals one percentage point). Most are trading above the par value at which they will be redeemed. Those who bought fixed-rate capital note preferreds with high coupons, issued by the troubled banks in 2008, thought they would be safe from call until 2013. Not so.

Congress and the Dodd-Frank Act foiled this seemingly smart strategy. That act says these preferreds can no longer be considered part of a bank's tier-one capital. This triggers a "statutory change" loophole that now allows banks to call these fixed-rate preferreds early. Think of it as Chris Dodd's going away present to his banker buddies.

Adjustable-rate securities normally trade at lower yields than comparable fixed-rate securities. They pay interest monthly or quarterly based on a Treasury bond index, LIBOR or changes in the CPI. The floating rate means these notes are designed to trade at par. But this hasn't been happening. That is because these securities come with an interest rate floor, typically at about 4%. When these bonds were issued that was considered meager. Today a 4% yield is a king's ransom.

Despite the healthy yield floor, most of these adjustables are selling below par today because they are viewed as inflation hedges in a period when inflation fears are absent. Thus you can still buy these adjustable-rate securities below par value. That is like getting a dollar for 90 cents. Hence, inflation protection is free, and the call risk is a positive. Once inflation fears are rekindled and rates spike, you'll be all set with these floating-rate securities.

Here are some adjustables you should consider buying:

AEGON NV SERIES 1 (AEB, 17) PERPETUAL PREFERRED RATED BAA2/BBB/BBB. This Dutch multi-line insurance giant was hard-hit during the financial crisis and still suffers under the weight of European banking concerns. This preferred is adjustable quarterly based on three-month LIBOR plus 87.5 basis points. It has a 4% floor and no ceiling, so at its current price it yields 5.71%. Even better, it's eligible for the 15% qualified dividend income tax rate for those in the highest tax bracket.

Closer to home I like GOLDMAN SACHS SERIES A PERPETUAL PREFERRED (GS A, 19) RATED BAA2/BBB–/A–. It has a floor rate of 3.75% and no ceiling and is tied to three-month LIBOR plus 75 basis points. It yields 4.93%, and it also benefits from the preferable tax rate on dividend income.

If you are willing to accept more risk buy the SLM CORP. 0% OF 3/15/17 (OSM, 21) RATED BA1/BBB–, yielding 6.15%. SLM is better known as Sallie Mae, the student loan organization, which went private in 2004. This adjustable is different in that it pays monthly, based on the percentage change in the year-over-year Consumer Price Index, plus 200 basis points. It has no floor or ceiling rate and currently pays 5.164%. I like it because there is no delay in recognizing an uptick in inflation, but unfortunately it isn't eligible for lower tax treatment.

I thought rates would climb because the Fed would use inflation as its primary tool in curing our economic woes. Bernanke flooded our economy with dollars, but inflation failed to materialize. Our economy was much weaker than I thought. Dark clouds still hang over global markets. While inflation is not an immediate concern, it can and does crop up when it's least expected. Given the current international turmoil and clearly nervous markets, investments offering inflation protection at no cost are a gift I find hard to resist.

Inflation Protection For Free

Richard Lehmann, 09.12.11, 6:00 PM ET

I have been pounding the table warning about rising interest rates for some time now. Well, it hasn't happened yet, and the latest Fed pronouncement makes it clear that short- and long-term rates will likely stay low for the next two years. My fear of rising rates caused me to recommend adjustable-rate securities. I was wrong on inflation, but my floating-rate picks have done quite well.

Since 2009 the adjustable-rate securities have enjoyed a spectacular resurgence, because most of them were issued by banks and other financial institutions that suffered huge declines during the financial crisis. These "too big to fail" institutions needed capital, and they issued all kinds of paper to bolster their books.

While fixed-rate issues experienced a similar rise, they are hurt by their call provisions. Specifically, most of the issues with a 5% or higher coupon rate are likely to be refinanced. This means they're trading on a yield-to-call basis with measly returns measured in basis points rather than percentages (100 basis points equals one percentage point). Most are trading above the par value at which they will be redeemed. Those who bought fixed-rate capital note preferreds with high coupons, issued by the troubled banks in 2008, thought they would be safe from call until 2013. Not so.

Congress and the Dodd-Frank Act foiled this seemingly smart strategy. That act says these preferreds can no longer be considered part of a bank's tier-one capital. This triggers a "statutory change" loophole that now allows banks to call these fixed-rate preferreds early. Think of it as Chris Dodd's going away present to his banker buddies.

Adjustable-rate securities normally trade at lower yields than comparable fixed-rate securities. They pay interest monthly or quarterly based on a Treasury bond index, LIBOR or changes in the CPI. The floating rate means these notes are designed to trade at par. But this hasn't been happening. That is because these securities come with an interest rate floor, typically at about 4%. When these bonds were issued that was considered meager. Today a 4% yield is a king's ransom.

Despite the healthy yield floor, most of these adjustables are selling below par today because they are viewed as inflation hedges in a period when inflation fears are absent. Thus you can still buy these adjustable-rate securities below par value. That is like getting a dollar for 90 cents. Hence, inflation protection is free, and the call risk is a positive. Once inflation fears are rekindled and rates spike, you'll be all set with these floating-rate securities.

Here are some adjustables you should consider buying:

AEGON NV SERIES 1 (AEB, 17) PERPETUAL PREFERRED RATED BAA2/BBB/BBB. This Dutch multi-line insurance giant was hard-hit during the financial crisis and still suffers under the weight of European banking concerns. This preferred is adjustable quarterly based on three-month LIBOR plus 87.5 basis points. It has a 4% floor and no ceiling, so at its current price it yields 5.71%. Even better, it's eligible for the 15% qualified dividend income tax rate for those in the highest tax bracket.

Closer to home I like GOLDMAN SACHS SERIES A PERPETUAL PREFERRED (GS A, 19) RATED BAA2/BBB–/A–. It has a floor rate of 3.75% and no ceiling and is tied to three-month LIBOR plus 75 basis points. It yields 4.93%, and it also benefits from the preferable tax rate on dividend income.

If you are willing to accept more risk buy the SLM CORP. 0% OF 3/15/17 (OSM, 21) RATED BA1/BBB–, yielding 6.15%. SLM is better known as Sallie Mae, the student loan organization, which went private in 2004. This adjustable is different in that it pays monthly, based on the percentage change in the year-over-year Consumer Price Index, plus 200 basis points. It has no floor or ceiling rate and currently pays 5.164%. I like it because there is no delay in recognizing an uptick in inflation, but unfortunately it isn't eligible for lower tax treatment.

I thought rates would climb because the Fed would use inflation as its primary tool in curing our economic woes. Bernanke flooded our economy with dollars, but inflation failed to materialize. Our economy was much weaker than I thought. Dark clouds still hang over global markets. While inflation is not an immediate concern, it can and does crop up when it's least expected. Given the current international turmoil and clearly nervous markets, investments offering inflation protection at no cost are a gift I find hard to resist.

Potential for Countrywide Default (Bloomberg)

BofA Keeps Countrywide Bankruptcy as Option

By Hugh Son and Dawn Kopecki - Sep 16, 2011

Bank of America Corp. (BAC), the lender burdened by its Countrywide Financial Corp. takeover, would consider putting the unit into bankruptcy if litigation losses threaten to cripple the parent, said four people with knowledge of the firm’s strategy.

The option of seeking court protection exists because the Charlotte, North Carolina-based bank maintained a separate legal identity for the subprime lender after the 2008 acquisition, said the people, who declined to be identified because the plans are private. A filing isn’t imminent and executives recognize the danger that it could backfire by casting doubt on the financial strength of the largest U.S. bank, the people said.

The threat of a Countrywide bankruptcy is a “nuclear” option that Chief Executive Officer Brian T. Moynihan could use as leverage against plaintiffs seeking refunds on bad mortgages, said analyst Mike Mayo of Credit Agricole Securities USA. Moynihan has booked at least $30 billion of costs for faulty home loans, most sold by Countrywide during the housing boom, and analysts estimate the total could double in coming years.

“If the losses become so great, how can Bank of America at least not discuss internally the relative tradeoff of a Countrywide bankruptcy?” Mayo, who has an “underperform” rating on the bank, said in an interview. “And if you pull out the bazooka, you’d better be prepared to use it.”

Countrywide Practices

Just before former CEO Kenneth D. Lewis bought Calabasas, California-based Countrywide, the firm was the biggest mortgage lender in the U.S. with 17 percent of the market and $408 billion of loans originated in 2007, according to industry newsletter Inside Mortgage Finance. Regulators later found its growth was fueled by lax lending standards, with loans marred by false or missing data about borrowers and properties.

Bankruptcy for Countrywide has gained credence with some investors and analysts after Bank of America lost almost half its market value this year. The shares have been whipsawed as the caseload of lawsuits by mortgage bond investors expanded, along with doubts about whether the bank has enough reserves to handle claims.

A Countrywide bankruptcy could halt legal proceedings and consolidate litigation into one court that would split up the subsidiary’s remaining assets for creditors, said Jay Westbrook, a law professor at the University of Texas at Austin. In effect, this would trade one type of litigation for another, one of the people said. The decision would turn on whether the potential savings of a filing outweigh the risks involved in disavowing some of the firm’s obligations, the person said.

What Could Go Wrong

Pitfalls include the possibility that a bankruptcy filing would cast doubt on the entire company’s willingness to support its other subsidiaries and damage Bank of America’s standing in the credit markets or with rating firms, hurting its ability to borrow, according to analysts.

“It’s not some sort of magic elixir that makes it all just go away,” Westbrook said. “I suspect that’s one reason they haven’t done it yet.”

Moynihan, 51, has been asked publicly about a potential Countrywide bankruptcy at least three times in the past year, most recently this week at a conference in New York. The bank’s mortgage division is his only unprofitable business, reporting a $25.3 billion pretax loss in the first half of this year.

Larry DiRita, a Bank of America spokesman, said he couldn’t comment on whether the company planned to file a Countrywide bankruptcy. The bank “took great pains to preserve the separate identity of Countrywide,” DiRita said.

Separate Accounting

Those steps include using separate accounting systems and profit-and-loss statements for Countrywide units, according to a report prepared for Bank of New York Mellon Corp. (BK), the trustee for a group of investors who agreed to an $8.5 billion settlement in June with Bank of America over faulty loans.

Bankruptcy “makes absolute good sense if they can do that,” said David Felt, a Washington-based consultant and former deputy general counsel at the Federal Housing Finance Agency. The FHFA sued Bank of America and 16 other banks this month to recover losses on about $200 billion in mortgage-backed securities sold to Fannie Mae and Freddie Mae, the government- backed mortgage firms. Bank of America and its subsidiaries created more than a quarter of those bonds.

“Given the size of these lawsuits, the potential liability could exceed the net worth of the subsidiary,” Felt said. “They could say the claims far exceed the amount that we have and therefore we need a bankruptcy court to pick and choose between those creditors.”

Assets Available

Countrywide has $11 billion in assets that could be depleted through demands to repurchase defective mortgages, Jonathan Glionna of Barclays Plc said in an Aug. 31 note. After that, Bank of America may not have any obligation to pay claims from Countrywide’s creditors, he said.

Typically, a corporation that acquires another firm’s assets isn’t liable for the seller’s debts, unless the transaction is considered a de facto merger or there was fraud in the takeover, Robert M. Daines, a Stanford Law School professor, wrote in a legal opinion prepared for BNY Mellon, trustee for the Countrywide mortgage bonds. Daines analyzed whether Bank of America would have to pay bond investors if Countrywide couldn’t.

American International Group Inc. (AIG), the insurer that sued Bank of America last month to recoup more than $10 billion in losses on Countrywide mortgage bonds, argued that the bank is a legal successor to the unit. New York-based AIG cited a series of transactions by Bank of America in 2008 that “were structured in such a way as to leave Countrywide unable to satisfy its massive contingent liabilities.”

Just in Case

Plaintiffs in the $8.5 billion settlement handled by BNY Mellon didn’t take any chances. Their agreement specified that Bank of America was responsible for making good on the payment because they were concerned that Countrywide might be thrown into bankruptcy, said Bob Madden, a Gibbs & Bruns LLP partner representing institutional investors that sued the bank.

“Bank of America didn’t do this stuff, it was Countrywide, which they had the misfortune of acquiring,” Madden said in an interview. “Anybody who tells you they have a solid handle on whether Bank of America can be forced to pay Countrywide liabilities hasn’t looked very closely at the issue.”

The chances of a bankruptcy filing rise “every time another suit gets put on the pile,” Madden said. Mark Herr, a spokesman for New York-based AIG and Stefanie Johnson of the FHFA declined to comment.

Bankruptcy’s Backlash

Bankruptcy would be a “last-ditch option,” and possibly a costly one, because counterparties might become hesitant to buy the parent company’s debt or open trading lines with its Merrill Lynch unit, David Hendler, a CreditSights Inc. analyst, said in a Sept. 8 note. Credit-rating firms could downgrade Bank of America subsidiaries, which benefit from the implicit support of their corporate parent, he said. That would drive up the bank’s cost of borrowing.

“Most counterparties I speak to think this would be a very difficult option for Bank of America and unlikely to be sanctioned by regulators,” said Manal Mehta, a partner at Branch Hill Capital, a San Francisco-based hedge fund that has bet against the lender’s stock in the past. “The whole reason they would pursue the nuclear option of a Countrywide bankruptcy would be to put this behind them, but all you would be doing is opening up a Pandora’s box.”

Outstanding Debt

Countrywide has $6.53 billion of debt outstanding, including $2.81 billion of senior unsecured notes, $2.2 billion of preferred securities and $529 million of mortgage-backed bonds, Bloomberg data and Bank of America figures show. The unit’s $1 billion in 6.25 percent notes have plunged 9.2 cents since Aug. 1 to 97.1 cents on the dollar as of Sept. 13, according to Trace, the bond price reporting system of the Financial Industry Regulatory Authority.

Management’s public stance on a potential Countrywide bankruptcy has evolved. In November, responding to a question from Mayo -- who had written a report that month entitled “Is a Countrywide Bankruptcy Possible?” -- Moynihan said he didn’t “see any liability that would make us think differently about working through it in the way we’re working.”

Since then, damage from Countrywide has steadily mounted as U.S.-owned Fannie Mae and Freddie Mac step up demands that the bank repurchase soured loans and new suits emerge, including from AIG and the FHFA. Further, New York Attorney General Eric Schneiderman is seeking to scuttle the $8.5 billion deal, which may result in greater mortgage costs, Bank of America has said.

Last month, when Moynihan was asked during a conference call held by fund manager and bank shareholder Bruce Berkowitz if a Chapter 11 restructuring would be a “viable solution” for Countrywide, the CEO declined to say what he’d do.

“When you face liabilities like this, we thought of every possible thing we could,” Moynihan said, “but I don’t think I’d comment on any outcome.”

To contact the reporters on this story: Hugh Son in New York at hson1@bloomberg.net

To contact the editor responsible for this story: Rick Green in New York at rgreen18@bloomberg.net.

.®2011 BLOOMBERG L.P. ALL RIGHTS RESERVED.

By Hugh Son and Dawn Kopecki - Sep 16, 2011

Bank of America Corp. (BAC), the lender burdened by its Countrywide Financial Corp. takeover, would consider putting the unit into bankruptcy if litigation losses threaten to cripple the parent, said four people with knowledge of the firm’s strategy.

The option of seeking court protection exists because the Charlotte, North Carolina-based bank maintained a separate legal identity for the subprime lender after the 2008 acquisition, said the people, who declined to be identified because the plans are private. A filing isn’t imminent and executives recognize the danger that it could backfire by casting doubt on the financial strength of the largest U.S. bank, the people said.

The threat of a Countrywide bankruptcy is a “nuclear” option that Chief Executive Officer Brian T. Moynihan could use as leverage against plaintiffs seeking refunds on bad mortgages, said analyst Mike Mayo of Credit Agricole Securities USA. Moynihan has booked at least $30 billion of costs for faulty home loans, most sold by Countrywide during the housing boom, and analysts estimate the total could double in coming years.

“If the losses become so great, how can Bank of America at least not discuss internally the relative tradeoff of a Countrywide bankruptcy?” Mayo, who has an “underperform” rating on the bank, said in an interview. “And if you pull out the bazooka, you’d better be prepared to use it.”

Countrywide Practices

Just before former CEO Kenneth D. Lewis bought Calabasas, California-based Countrywide, the firm was the biggest mortgage lender in the U.S. with 17 percent of the market and $408 billion of loans originated in 2007, according to industry newsletter Inside Mortgage Finance. Regulators later found its growth was fueled by lax lending standards, with loans marred by false or missing data about borrowers and properties.

Bankruptcy for Countrywide has gained credence with some investors and analysts after Bank of America lost almost half its market value this year. The shares have been whipsawed as the caseload of lawsuits by mortgage bond investors expanded, along with doubts about whether the bank has enough reserves to handle claims.

A Countrywide bankruptcy could halt legal proceedings and consolidate litigation into one court that would split up the subsidiary’s remaining assets for creditors, said Jay Westbrook, a law professor at the University of Texas at Austin. In effect, this would trade one type of litigation for another, one of the people said. The decision would turn on whether the potential savings of a filing outweigh the risks involved in disavowing some of the firm’s obligations, the person said.

What Could Go Wrong

Pitfalls include the possibility that a bankruptcy filing would cast doubt on the entire company’s willingness to support its other subsidiaries and damage Bank of America’s standing in the credit markets or with rating firms, hurting its ability to borrow, according to analysts.

“It’s not some sort of magic elixir that makes it all just go away,” Westbrook said. “I suspect that’s one reason they haven’t done it yet.”

Moynihan, 51, has been asked publicly about a potential Countrywide bankruptcy at least three times in the past year, most recently this week at a conference in New York. The bank’s mortgage division is his only unprofitable business, reporting a $25.3 billion pretax loss in the first half of this year.

Larry DiRita, a Bank of America spokesman, said he couldn’t comment on whether the company planned to file a Countrywide bankruptcy. The bank “took great pains to preserve the separate identity of Countrywide,” DiRita said.

Separate Accounting

Those steps include using separate accounting systems and profit-and-loss statements for Countrywide units, according to a report prepared for Bank of New York Mellon Corp. (BK), the trustee for a group of investors who agreed to an $8.5 billion settlement in June with Bank of America over faulty loans.

Bankruptcy “makes absolute good sense if they can do that,” said David Felt, a Washington-based consultant and former deputy general counsel at the Federal Housing Finance Agency. The FHFA sued Bank of America and 16 other banks this month to recover losses on about $200 billion in mortgage-backed securities sold to Fannie Mae and Freddie Mae, the government- backed mortgage firms. Bank of America and its subsidiaries created more than a quarter of those bonds.

“Given the size of these lawsuits, the potential liability could exceed the net worth of the subsidiary,” Felt said. “They could say the claims far exceed the amount that we have and therefore we need a bankruptcy court to pick and choose between those creditors.”

Assets Available

Countrywide has $11 billion in assets that could be depleted through demands to repurchase defective mortgages, Jonathan Glionna of Barclays Plc said in an Aug. 31 note. After that, Bank of America may not have any obligation to pay claims from Countrywide’s creditors, he said.

Typically, a corporation that acquires another firm’s assets isn’t liable for the seller’s debts, unless the transaction is considered a de facto merger or there was fraud in the takeover, Robert M. Daines, a Stanford Law School professor, wrote in a legal opinion prepared for BNY Mellon, trustee for the Countrywide mortgage bonds. Daines analyzed whether Bank of America would have to pay bond investors if Countrywide couldn’t.

American International Group Inc. (AIG), the insurer that sued Bank of America last month to recoup more than $10 billion in losses on Countrywide mortgage bonds, argued that the bank is a legal successor to the unit. New York-based AIG cited a series of transactions by Bank of America in 2008 that “were structured in such a way as to leave Countrywide unable to satisfy its massive contingent liabilities.”

Just in Case

Plaintiffs in the $8.5 billion settlement handled by BNY Mellon didn’t take any chances. Their agreement specified that Bank of America was responsible for making good on the payment because they were concerned that Countrywide might be thrown into bankruptcy, said Bob Madden, a Gibbs & Bruns LLP partner representing institutional investors that sued the bank.

“Bank of America didn’t do this stuff, it was Countrywide, which they had the misfortune of acquiring,” Madden said in an interview. “Anybody who tells you they have a solid handle on whether Bank of America can be forced to pay Countrywide liabilities hasn’t looked very closely at the issue.”

The chances of a bankruptcy filing rise “every time another suit gets put on the pile,” Madden said. Mark Herr, a spokesman for New York-based AIG and Stefanie Johnson of the FHFA declined to comment.

Bankruptcy’s Backlash

Bankruptcy would be a “last-ditch option,” and possibly a costly one, because counterparties might become hesitant to buy the parent company’s debt or open trading lines with its Merrill Lynch unit, David Hendler, a CreditSights Inc. analyst, said in a Sept. 8 note. Credit-rating firms could downgrade Bank of America subsidiaries, which benefit from the implicit support of their corporate parent, he said. That would drive up the bank’s cost of borrowing.

“Most counterparties I speak to think this would be a very difficult option for Bank of America and unlikely to be sanctioned by regulators,” said Manal Mehta, a partner at Branch Hill Capital, a San Francisco-based hedge fund that has bet against the lender’s stock in the past. “The whole reason they would pursue the nuclear option of a Countrywide bankruptcy would be to put this behind them, but all you would be doing is opening up a Pandora’s box.”

Outstanding Debt

Countrywide has $6.53 billion of debt outstanding, including $2.81 billion of senior unsecured notes, $2.2 billion of preferred securities and $529 million of mortgage-backed bonds, Bloomberg data and Bank of America figures show. The unit’s $1 billion in 6.25 percent notes have plunged 9.2 cents since Aug. 1 to 97.1 cents on the dollar as of Sept. 13, according to Trace, the bond price reporting system of the Financial Industry Regulatory Authority.

Management’s public stance on a potential Countrywide bankruptcy has evolved. In November, responding to a question from Mayo -- who had written a report that month entitled “Is a Countrywide Bankruptcy Possible?” -- Moynihan said he didn’t “see any liability that would make us think differently about working through it in the way we’re working.”

Since then, damage from Countrywide has steadily mounted as U.S.-owned Fannie Mae and Freddie Mac step up demands that the bank repurchase soured loans and new suits emerge, including from AIG and the FHFA. Further, New York Attorney General Eric Schneiderman is seeking to scuttle the $8.5 billion deal, which may result in greater mortgage costs, Bank of America has said.

Last month, when Moynihan was asked during a conference call held by fund manager and bank shareholder Bruce Berkowitz if a Chapter 11 restructuring would be a “viable solution” for Countrywide, the CEO declined to say what he’d do.

“When you face liabilities like this, we thought of every possible thing we could,” Moynihan said, “but I don’t think I’d comment on any outcome.”

To contact the reporters on this story: Hugh Son in New York at hson1@bloomberg.net

To contact the editor responsible for this story: Rick Green in New York at rgreen18@bloomberg.net.

.®2011 BLOOMBERG L.P. ALL RIGHTS RESERVED.

Top 10 Investment Scams (NASAA.org)

August 23, 2011

Con Artists Find Profit in Get-Rich Schemes Tied to Economic Uncertainty

NASAA Identifies Investor Threats Among Financial Products and Practices

WASHINGTON (August 23, 2011) – The North American Securities Administrators Association (NASAA) today released its annual list of financial products and practices that threaten to trap unwary investors, many by taking advantage of investors troubled by lingering economic uncertainty and volatile stock markets.

“Con artists follow the news and seek ways to exploit the headlines to their advantage while leaving investors holding an empty bag,” said David Massey, NASAA President and North Carolina Deputy Securities Administrator.

Massey said headline-related investor complaints reaching state and provincial securities regulators include questionable claims, such as: “Realize safety and appreciation in gold;” “Wave energy: the future to power our homes;” “Synthetic fuels take the oilman out of our pockets;” and “Invest in foreclosed homes, help others and make a fortune!”

“Promoters often offer investors an opportunity to get in on the ‘ground floor’ of new technology or ideas to help others and make a great economic return,” Massey said. “Unsuspecting investors can be lured into these schemes, especially if they sound familiar. These offerings require careful research and a strong reminder that if it sounds too good to be true, it probably is not true, nor will it be profitable to anyone but the promoter.”

The following alphabetical listing of the Top 10 financial products and practices that threaten to trap unwary investors was compiled by the securities regulators in NASAA’s Enforcement Section.

PRODUCTS: distressed real estate schemes, energy investments, gold and precious metal investments, promissory notes, and securitized life settlement contracts.

PRACTICES: affinity fraud, bogus or exaggerated credentials, mirror trading, private placements, and securities and investment advice offered by unlicensed agents.

Massey urged investors to learn the warning signs of investment fraud and independently verify any investment opportunity as well as the background of the person and company offering the investment. State and provincial securities regulators provide detailed background information about those who sell securities or give investment advice, as well as about the products being offered.

“Investors should do business only with licensed brokers and investment advisers and should report any suspicion of investment fraud to their state or provincial securities regulator,” Massey said.

NASAA is the oldest international organization devoted to investor protection. Its membership consists of the securities administrators in the 50 states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Canada and Mexico.

2011 NASAA Top Investor Traps and Threats

Products

Distressed Real Estate Schemes. Investment offerings involving distressed real estate have been on the rise following the collapse of the real estate bubble. While many legitimate investment offerings are tied to real estate, investment pools targeting distressed real estate have become increasingly popular with con artists as well as investors. Investments in properties that are bank-owned, in foreclosure, pending short sales or otherwise in distress inevitably carry substantial risks and should be evaluated carefully. Just like other securities, interests in real estate ventures also must be registered with state securities regulators.

In February 2011, a Florida man pleaded guilty to conspiracy to commit mail and wire fraud in a scheme that solicited $2.3 million from 39 investors nationwide to purchase and refurbish distressed properties and, in turn, sell them for a profit. Investors were issued corporate promissory notes with returns of up to 12 percent. Investigators determined that the investments were used for personal gain and to make Ponzi-type distributions to other investors.

Energy Investments. Swindlers continue to attempt to trick investors by using high-pressure marketing tactics touting the mystique associated with untapped oil and gas reserves and bountiful production runs. Even genuine oil and gas investments almost always bear a high degree of risk. Investors must realize the distinct possibility that they could lose their total investment in legitimate ventures. Energy investments tend to be poor alternatives for those planning for retirement and should be avoided by anyone who cannot afford to strike out when trying to strike it rich.

Colorado securities regulators issued a cease and desist order earlier this year against a Texas oil and gas company for allegedly violating state securities registration and licensing provisions. The case came to light after a company sales agents unwittingly “cold called” an employee of the Colorado Division of Securities and offered a joint venture interest in two Pennsylvania oil wells with next to no drilling risk.

Gold and Precious Metals. Higher precious metal prices and the promise of an ever-appreciating, “tangible” asset have lured unsuspecting investors into a variety of scams. Many recent schemes are variations on old themes: a promoter seeking capital for extraction equipment to reopen a long dormant mine in exchange for a full refund plus interest and a stake in the mine. In another case, operators claimed to have special coins or nuggets that they can store or trade for investors in special markets for high profits and returns. Investors suffered heavy losses in each of these cases. And despite ubiquitous promises to the contrary, there are no guarantees with gold or precious metals, even in legitimate markets. In the spring of 2011, silver’s value declined by 30 percent in a single three-week period.

In 2011, the founder of Florida-based Gold Bullion Exchange pleaded guilty to fraud charges in a scheme that collapsed on more than 1,400 investors who lost $29.5 million. Investors were solicited through a sophisticated telemarketing operation to purchase precious metal bullion using purported “leverage” financing. Investors were led to believe that they would need only to provide a fraction of the total cost of the purchased metals, with the remainder of the purchase price to be covered by margin-type financing, which would purportedly be extended to the investor by a “clearing firm.” State and federal investigators found that the clearing firm delayed or ignored requests by investors to sell their precious metals investments. Despite having paid commissions and fees of up to 18 percent for their precious metals investments, investigators determined that no bullion was purchased.

Promissory Notes. Investors seeking safety in uncertain economic conditions or those enticed by the promise of big returns through a private, informal loan arrangement may suffer deep losses investing in unregistered or fraudulent promissory notes. These notes give investors a false sense of security with promises or guarantees of fixed interest rates and safety of principal. However, even legitimate notes carry some risk that the issuers may not be able to meet their obligations. Often initially pitched as personal loans or short-term business arrangements, most promissory notes and the persons who sell them must be registered with state securities regulators. Unregistered promissory notes are often covers for Ponzi schemes and other scams. Investors should check with their state regulator to determine whether a promissory note and the seller/borrower are properly registered.

A former FBI agent was convicted in Alabama this year after an investigation by Alabama securities regulators revealed that he used promissory notes guaranteeing returns as high as 12 percent to lure investors into a Ponzi scheme. The funds were to be invested in real estate and medical technology ventures, but investigators determined that the former agent used most of the funds, more than $4 million, to pay Ponzi-style returns to previous investors and for his personal use.

Securitized Life Settlement Contracts. Life settlement contracts are investments in the death benefits of insurance policies that insure the lives of unrelated third parties. Legitimate investments in life settlement contracts involve a high degree of risk, and investors may be responsible for routinely paying costly premiums for policies that insure people who outlive their life expectancies. Outside the legitimate offerings, crooks are embracing new schemes to deceive even cautious investors. For example, “securitized” life settlement contracts are increasingly popular investments that combine life settlement contracts with traditional securities, such as bonds that supposedly guarantee a fixed return on a fixed date, regardless of whether the insured outlive their life expectancies. This risk-reducing structure has too often proven fraudulent and left victims with nothing but worthless paper issued by a bonding company that does not maintain sufficient assets to fulfill the guarantee, operates in an unregulated overseas territory or simply does not exist.

In 2011, two executives of National Life Settlements LLC of Houston were indicted on charges of securities fraud and the sale of unregistered securities after an undercover investigation by Texas securities regulators determined the pair had sold $30 million in unregistered promissory notes secured by life settlement contracts. One of the executives was a three-time convicted felon with a long history of investment fraud. The promise of a safe investment with annual returns as high as 10 percent served as bait to lure investors into what a court-appointed receiver testified was a Ponzi scheme. The company sold these unregistered investments largely to retired teachers and state employees through a network of financial professions, including insurance agents and securities brokers. The criminal indictment alleges that investors' money was spent on commissions and personal expenses, including the purchase of houses and cars.

Practices

Affinity Fraud. Marketing a fraudulent investment scheme to members of an identifiable group or organization continues to be a highly successful and lucrative practice for Ponzi scheme operators and other fraudsters. A recent national study of Ponzi schemes over the past decade found that one in four were marketed to affinity groups to increase the scheme's credibility and build the fraud. The most commonly exploited are the elderly or retired, religious groups, and ethnic groups. Investment decisions should always be made based on careful evaluation of the underlying merits rather than common affiliations with the promoter.

A 73-year-old North Carolina man pleaded guilty this year to 19 felony counts of securities fraud following an investigation by North Carolina securities regulators that determined he had collected more than $18.5 million from more than 100 investors, many of whom he knew from church or other social circles. The investments for venture capital investments in various unspecified companies came with a promissory note guaranteeing annual returns of between 10 and 50 percent. Bank records revealed a Ponzi scheme using money from new investors to pay returns to previous investors.

Bogus or Exaggerated Credentials. State securities regulators have led the effort to prevent the misuse of credentials or designations intended to imply special expertise or training in advising senior citizens on financial matters. Since 2008, 29 states have adopted laws or rules preventing such misuse. Now, state regulators are noting an increase in the use of other bogus credentials or exaggerated designations. State securities regulators have encountered salesmen pitching financial services or products with nonexistent law degrees or CPA certificates and expired or nonexistent CRD numbers. Others have boasted of impressive sounding designations that prove to be meaningless. In every circumstance, investors should press for full disclosure and the meaning behind all designations, and should check with their state regulator if they have any suspicions about claimed credentials.

Securities regulators in Utah came across a broker who listed “C.H.S.G.” after his name on his business card. When asked, the broker told regulators the initials stood for “Certified High School Graduate.”

Mirror Trading. The securities market is constantly evolving to provide investors with new products, different platforms and a variety of choices. The latest evolution is “mirror trading,” which is promoted as an automated trading platform that ensures investors will participate in real-time transactions placed or executed by a skilled and knowledgeable third party. Whenever the third party executes a trade in his or her account, the same trade is mechanically placed on behalf of the investor in the investor’s account. Investors should not be lulled into a false sense of security, and they need to continue to objectively evaluate and carefully consider all new or popular investment platforms. They should also recognize that unscrupulous traders and promoters may use trendy platforms such as mirror trading as a way to launch fraudulent schemes or manipulate markets by lying about their qualifications, misrepresenting the success of their strategies, or concealing their motivations and conflicts of interest.

Private Placements. Investors should be aware that, even in the case of legitimate issuers, private placement offerings are highly illiquid, generally lack transparency and have little regulatory oversight. In the United States, the federal exemption for private placement offerings provided under Rule 506 of Regulation D continues to be abused by criminals. Although properly used by many legitimate issuers, unscrupulous promoters use Rule 506 to cloak an otherwise fraudulent offering in legitimacy.

In 2011, U.S. and Canadian authorities convicted three individuals of criminal fraud charges related to the sale of $33 million in oil and gas private placement offerings. The defendants claimed the securities were exempt from registration under Rule 506. In an attempt to avoid regulatory scrutiny, the defendants organized their company in the Bahamas and sold the securities from a boiler room located in Ontario, Canada, while telling investors the company was located in Kentucky. Securities regulators also have taken civil fraud actions against private placement issuers, Medical Capital Holdings, Inc. and Provident Royalties, which raised more than $500 million from investors though private offerings sold by dozens of broker-dealers. The companies are alleged to have defrauded investors by misrepresenting the use of the investment proceeds and misappropriating millions in investor funds.

Securities and Investment Advice Offered by Unlicensed Agents. State securities regulators have identified a consistent increase in investor complaints regarding salesmen unlicensed as securities brokers or investment advisers giving investment advice or effecting securities transactions. For example, insurance agents offering securities or investment advice without a securities license have not demonstrated sufficient expertise to legally recommend that an investor liquidate securities holdings in favor of insurance products. Investors are often unaware that their insurance agent may not be licensed to give investment advice, and these recommendations too often turn out to be unsuitable or result in investors placed in under-performing products or those with hidden fees or long lock-up periods. Investors should insist that any time anyone recommends or suggests any transaction related to an investor’s stocks, bonds, mutual funds or other securities holdings, the person must produce a proper license.

In 2011, an insurance agent unlicensed to sell securities and his manager were barred from working in the Missouri securities industry for five years after Missouri securities regulators uncovered a complex scheme that saw the liquidation of more than $7 million in securities investments from 180 customer accounts. Agents had moved most of these funds into proprietary fixed or equity indexed annuities.

For more information:

Bob Webster, Director of Communication

202-737-0900

Con Artists Find Profit in Get-Rich Schemes Tied to Economic Uncertainty

NASAA Identifies Investor Threats Among Financial Products and Practices

WASHINGTON (August 23, 2011) – The North American Securities Administrators Association (NASAA) today released its annual list of financial products and practices that threaten to trap unwary investors, many by taking advantage of investors troubled by lingering economic uncertainty and volatile stock markets.

“Con artists follow the news and seek ways to exploit the headlines to their advantage while leaving investors holding an empty bag,” said David Massey, NASAA President and North Carolina Deputy Securities Administrator.

Massey said headline-related investor complaints reaching state and provincial securities regulators include questionable claims, such as: “Realize safety and appreciation in gold;” “Wave energy: the future to power our homes;” “Synthetic fuels take the oilman out of our pockets;” and “Invest in foreclosed homes, help others and make a fortune!”

“Promoters often offer investors an opportunity to get in on the ‘ground floor’ of new technology or ideas to help others and make a great economic return,” Massey said. “Unsuspecting investors can be lured into these schemes, especially if they sound familiar. These offerings require careful research and a strong reminder that if it sounds too good to be true, it probably is not true, nor will it be profitable to anyone but the promoter.”

The following alphabetical listing of the Top 10 financial products and practices that threaten to trap unwary investors was compiled by the securities regulators in NASAA’s Enforcement Section.

PRODUCTS: distressed real estate schemes, energy investments, gold and precious metal investments, promissory notes, and securitized life settlement contracts.

PRACTICES: affinity fraud, bogus or exaggerated credentials, mirror trading, private placements, and securities and investment advice offered by unlicensed agents.

Massey urged investors to learn the warning signs of investment fraud and independently verify any investment opportunity as well as the background of the person and company offering the investment. State and provincial securities regulators provide detailed background information about those who sell securities or give investment advice, as well as about the products being offered.

“Investors should do business only with licensed brokers and investment advisers and should report any suspicion of investment fraud to their state or provincial securities regulator,” Massey said.

NASAA is the oldest international organization devoted to investor protection. Its membership consists of the securities administrators in the 50 states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Canada and Mexico.

2011 NASAA Top Investor Traps and Threats

Products

Distressed Real Estate Schemes. Investment offerings involving distressed real estate have been on the rise following the collapse of the real estate bubble. While many legitimate investment offerings are tied to real estate, investment pools targeting distressed real estate have become increasingly popular with con artists as well as investors. Investments in properties that are bank-owned, in foreclosure, pending short sales or otherwise in distress inevitably carry substantial risks and should be evaluated carefully. Just like other securities, interests in real estate ventures also must be registered with state securities regulators.

In February 2011, a Florida man pleaded guilty to conspiracy to commit mail and wire fraud in a scheme that solicited $2.3 million from 39 investors nationwide to purchase and refurbish distressed properties and, in turn, sell them for a profit. Investors were issued corporate promissory notes with returns of up to 12 percent. Investigators determined that the investments were used for personal gain and to make Ponzi-type distributions to other investors.

Energy Investments. Swindlers continue to attempt to trick investors by using high-pressure marketing tactics touting the mystique associated with untapped oil and gas reserves and bountiful production runs. Even genuine oil and gas investments almost always bear a high degree of risk. Investors must realize the distinct possibility that they could lose their total investment in legitimate ventures. Energy investments tend to be poor alternatives for those planning for retirement and should be avoided by anyone who cannot afford to strike out when trying to strike it rich.

Colorado securities regulators issued a cease and desist order earlier this year against a Texas oil and gas company for allegedly violating state securities registration and licensing provisions. The case came to light after a company sales agents unwittingly “cold called” an employee of the Colorado Division of Securities and offered a joint venture interest in two Pennsylvania oil wells with next to no drilling risk.

Gold and Precious Metals. Higher precious metal prices and the promise of an ever-appreciating, “tangible” asset have lured unsuspecting investors into a variety of scams. Many recent schemes are variations on old themes: a promoter seeking capital for extraction equipment to reopen a long dormant mine in exchange for a full refund plus interest and a stake in the mine. In another case, operators claimed to have special coins or nuggets that they can store or trade for investors in special markets for high profits and returns. Investors suffered heavy losses in each of these cases. And despite ubiquitous promises to the contrary, there are no guarantees with gold or precious metals, even in legitimate markets. In the spring of 2011, silver’s value declined by 30 percent in a single three-week period.

In 2011, the founder of Florida-based Gold Bullion Exchange pleaded guilty to fraud charges in a scheme that collapsed on more than 1,400 investors who lost $29.5 million. Investors were solicited through a sophisticated telemarketing operation to purchase precious metal bullion using purported “leverage” financing. Investors were led to believe that they would need only to provide a fraction of the total cost of the purchased metals, with the remainder of the purchase price to be covered by margin-type financing, which would purportedly be extended to the investor by a “clearing firm.” State and federal investigators found that the clearing firm delayed or ignored requests by investors to sell their precious metals investments. Despite having paid commissions and fees of up to 18 percent for their precious metals investments, investigators determined that no bullion was purchased.

Promissory Notes. Investors seeking safety in uncertain economic conditions or those enticed by the promise of big returns through a private, informal loan arrangement may suffer deep losses investing in unregistered or fraudulent promissory notes. These notes give investors a false sense of security with promises or guarantees of fixed interest rates and safety of principal. However, even legitimate notes carry some risk that the issuers may not be able to meet their obligations. Often initially pitched as personal loans or short-term business arrangements, most promissory notes and the persons who sell them must be registered with state securities regulators. Unregistered promissory notes are often covers for Ponzi schemes and other scams. Investors should check with their state regulator to determine whether a promissory note and the seller/borrower are properly registered.

A former FBI agent was convicted in Alabama this year after an investigation by Alabama securities regulators revealed that he used promissory notes guaranteeing returns as high as 12 percent to lure investors into a Ponzi scheme. The funds were to be invested in real estate and medical technology ventures, but investigators determined that the former agent used most of the funds, more than $4 million, to pay Ponzi-style returns to previous investors and for his personal use.

Securitized Life Settlement Contracts. Life settlement contracts are investments in the death benefits of insurance policies that insure the lives of unrelated third parties. Legitimate investments in life settlement contracts involve a high degree of risk, and investors may be responsible for routinely paying costly premiums for policies that insure people who outlive their life expectancies. Outside the legitimate offerings, crooks are embracing new schemes to deceive even cautious investors. For example, “securitized” life settlement contracts are increasingly popular investments that combine life settlement contracts with traditional securities, such as bonds that supposedly guarantee a fixed return on a fixed date, regardless of whether the insured outlive their life expectancies. This risk-reducing structure has too often proven fraudulent and left victims with nothing but worthless paper issued by a bonding company that does not maintain sufficient assets to fulfill the guarantee, operates in an unregulated overseas territory or simply does not exist.

In 2011, two executives of National Life Settlements LLC of Houston were indicted on charges of securities fraud and the sale of unregistered securities after an undercover investigation by Texas securities regulators determined the pair had sold $30 million in unregistered promissory notes secured by life settlement contracts. One of the executives was a three-time convicted felon with a long history of investment fraud. The promise of a safe investment with annual returns as high as 10 percent served as bait to lure investors into what a court-appointed receiver testified was a Ponzi scheme. The company sold these unregistered investments largely to retired teachers and state employees through a network of financial professions, including insurance agents and securities brokers. The criminal indictment alleges that investors' money was spent on commissions and personal expenses, including the purchase of houses and cars.

Practices

Affinity Fraud. Marketing a fraudulent investment scheme to members of an identifiable group or organization continues to be a highly successful and lucrative practice for Ponzi scheme operators and other fraudsters. A recent national study of Ponzi schemes over the past decade found that one in four were marketed to affinity groups to increase the scheme's credibility and build the fraud. The most commonly exploited are the elderly or retired, religious groups, and ethnic groups. Investment decisions should always be made based on careful evaluation of the underlying merits rather than common affiliations with the promoter.

A 73-year-old North Carolina man pleaded guilty this year to 19 felony counts of securities fraud following an investigation by North Carolina securities regulators that determined he had collected more than $18.5 million from more than 100 investors, many of whom he knew from church or other social circles. The investments for venture capital investments in various unspecified companies came with a promissory note guaranteeing annual returns of between 10 and 50 percent. Bank records revealed a Ponzi scheme using money from new investors to pay returns to previous investors.

Bogus or Exaggerated Credentials. State securities regulators have led the effort to prevent the misuse of credentials or designations intended to imply special expertise or training in advising senior citizens on financial matters. Since 2008, 29 states have adopted laws or rules preventing such misuse. Now, state regulators are noting an increase in the use of other bogus credentials or exaggerated designations. State securities regulators have encountered salesmen pitching financial services or products with nonexistent law degrees or CPA certificates and expired or nonexistent CRD numbers. Others have boasted of impressive sounding designations that prove to be meaningless. In every circumstance, investors should press for full disclosure and the meaning behind all designations, and should check with their state regulator if they have any suspicions about claimed credentials.

Securities regulators in Utah came across a broker who listed “C.H.S.G.” after his name on his business card. When asked, the broker told regulators the initials stood for “Certified High School Graduate.”

Mirror Trading. The securities market is constantly evolving to provide investors with new products, different platforms and a variety of choices. The latest evolution is “mirror trading,” which is promoted as an automated trading platform that ensures investors will participate in real-time transactions placed or executed by a skilled and knowledgeable third party. Whenever the third party executes a trade in his or her account, the same trade is mechanically placed on behalf of the investor in the investor’s account. Investors should not be lulled into a false sense of security, and they need to continue to objectively evaluate and carefully consider all new or popular investment platforms. They should also recognize that unscrupulous traders and promoters may use trendy platforms such as mirror trading as a way to launch fraudulent schemes or manipulate markets by lying about their qualifications, misrepresenting the success of their strategies, or concealing their motivations and conflicts of interest.

Private Placements. Investors should be aware that, even in the case of legitimate issuers, private placement offerings are highly illiquid, generally lack transparency and have little regulatory oversight. In the United States, the federal exemption for private placement offerings provided under Rule 506 of Regulation D continues to be abused by criminals. Although properly used by many legitimate issuers, unscrupulous promoters use Rule 506 to cloak an otherwise fraudulent offering in legitimacy.

In 2011, U.S. and Canadian authorities convicted three individuals of criminal fraud charges related to the sale of $33 million in oil and gas private placement offerings. The defendants claimed the securities were exempt from registration under Rule 506. In an attempt to avoid regulatory scrutiny, the defendants organized their company in the Bahamas and sold the securities from a boiler room located in Ontario, Canada, while telling investors the company was located in Kentucky. Securities regulators also have taken civil fraud actions against private placement issuers, Medical Capital Holdings, Inc. and Provident Royalties, which raised more than $500 million from investors though private offerings sold by dozens of broker-dealers. The companies are alleged to have defrauded investors by misrepresenting the use of the investment proceeds and misappropriating millions in investor funds.

Securities and Investment Advice Offered by Unlicensed Agents. State securities regulators have identified a consistent increase in investor complaints regarding salesmen unlicensed as securities brokers or investment advisers giving investment advice or effecting securities transactions. For example, insurance agents offering securities or investment advice without a securities license have not demonstrated sufficient expertise to legally recommend that an investor liquidate securities holdings in favor of insurance products. Investors are often unaware that their insurance agent may not be licensed to give investment advice, and these recommendations too often turn out to be unsuitable or result in investors placed in under-performing products or those with hidden fees or long lock-up periods. Investors should insist that any time anyone recommends or suggests any transaction related to an investor’s stocks, bonds, mutual funds or other securities holdings, the person must produce a proper license.

In 2011, an insurance agent unlicensed to sell securities and his manager were barred from working in the Missouri securities industry for five years after Missouri securities regulators uncovered a complex scheme that saw the liquidation of more than $7 million in securities investments from 180 customer accounts. Agents had moved most of these funds into proprietary fixed or equity indexed annuities.

For more information:

Bob Webster, Director of Communication

202-737-0900

The GAO Report on Immediate Annuities

The Government Accountability Office endorses immediate annuities as a supplement to social security.

Report to the Chairman, Special

Committee on Aging, U.S. Senate

June 2011

RETIREMENT

INCOME

Ensuring Income

throughout

Retirement GAO-11-400

http://www.gao.gov/new.items/d11400.pdf

Report to the Chairman, Special

Committee on Aging, U.S. Senate

June 2011

RETIREMENT

INCOME

Ensuring Income

throughout

Retirement GAO-11-400

http://www.gao.gov/new.items/d11400.pdf

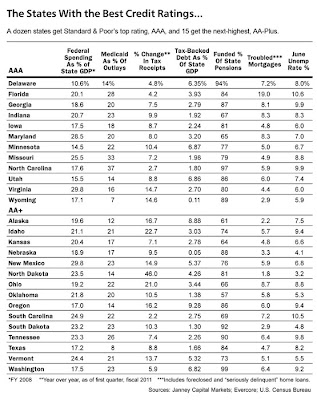

The Best and the Worst States for Muni Bonds (Barrons)

Barron's Cover | MONDAY, AUGUST 29, 2011

Good, Bad and Ugly