7 to-dos between 55 and 65 for a better retirement

By Dana Anspach

Shutterstock.com

It was Roy Disney who said, "When your values are clear, your decisions are easy."

Many retirement decisions aren't only tied to your values, they are also irrevocable decisions. This isn't the time to play it by ear. By planning ahead, and starting with your values, retirement decisions do get easier.

Work your way through these seven action items, and you'll be facing your own retirement planning with ease:

1. Prioritize values

Time and money are often interchangeable. You may be able to retire earlier, giving you more free time, but the trade-off might entail living on less. For some of you this is an acceptable trade-off. For others, it isn't.

Now is the perfect time to dig deep, and think about what matters the most to you. There are no right or wrong answers. This is a personal choice. When you are clear about your values, it makes money decisions far easier. It even makes spending decisions easier. If you have a clear goal in mind and a target monthly or annual savings number to hit, then it becomes easier to say no to less important items that may hinder you from reaching your goal as quickly.

Once you have clear goals, find pictures and written statements that inspire you. Put them somewhere where you see them every day. Who cares if your family or co-workers think you're a bit wacky. They’re your goals, not theirs.

2. Know your net worth

Have you ever had to watch yourself on video? It's an uncomfortable feeling. Anyone who is in the entertainment field has to overcome this discomfort and learn to watch themselves over and over. This is how they improve.

This same discipline works for your finances. It can be uncomfortable to take an objective look at how much you have, how much you save, and how much you spend. If you want to improve this is a necessity. I started this practice years ago when I embarked on an effort to get out of debt. I tracked remaining credit card balances every single month. It was a powerful motivator to watch them go down.

For retirement, tracking starts with a net worth statement. This a list of what you own, minus what you owe. You'll want to update it each and every year. As an adviser, it is fun for me to go back 10 years and show my client's their net worth statements then versus now. People are often surprised by how much progress they’ve made. You won't know unless you track it.

3. Estimate your benefits

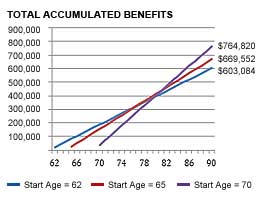

Social Security offers financial features that cannot be purchased on the open market. Take advantage of this. The earliest age you can claim is 62, but you get a powerful boost if you wait and claim later. And if you're married, by planning together you and your spouse can take advantage of spousal benefits and survivor benefits. Survivor benefits function as a great form of life insurance, as the highest monthly benefit amount between the two of you is the amount that continues on for a surviving spouse, regardless of who passes first. By delaying the start date of the highest earner's benefit, you can be sure the survivor benefit is as large as possible,

And if you are divorced, but have a prior marriage that lasted at least 10 years, don't forget that you have access to spousal benefits too.

4. Get a handle on health care

Too many people think Medicare will cover most of their health care costs once they reach age 65. Wrong. On average Medicare covers about 50% of your health care costs. The 50% that you pay will include Medicare Part B premiums (which are means tested — meaning the more income you have the more you pay), a supplemental policy, long-term care, and then there's dental care, eye care, hearing, copays, deductibles, etc.

When I run retirement expense projections I typically estimate about $10,000 a year per person for health care. This number can trend lower for those with retirement incomes under $75,000 and higher for those with incomes over $150,000. Of course you are already paying a portion of this now, as most people are paying at least a couple thousand a year in of out-of-pocket health care costs while working, so the incremental difference may not be as high as $10,000 a year. Your personal costs will also depend on things like where you live and how healthy you are.

5. Make an income timeline

In school I wasn't much of a history buff. I didn't like timelines as I couldn't see how memorizing the exact date of a bunch of historical events was going to have much relevance to my life. But future timelines are different. I love them.

A future timeline can be organized by month or by year. For retirement projections yearly is best. For budgeting purposes monthly works. You can use Excel or graph paper to lay out a timeline. Each column represents a year, and put in your expected income and expenses for that year and calculate the difference. This is a useful tool for laying out the varied start dates of sources of income, like Social Security and pensions, which may start midyear. You can also use it to account for periodic expenses, like a new car purchase, which may occur every few years, or only once a decade.

I use a monthly timeline for budgeting purposes so I know when to expect annual invoices for insurance premiums, home warranties, Christmas spending, and car repairs. I use a year-by-year timeline for retirement planning projections.

6. Outline options

There may be retirement possibilities you haven't thought of yet. Perhaps substituting a lower paying, lower stress job for a few years would work. In many cases this works if you stop contributing to savings during your lower earning years but don't start withdrawing yet. A transition to part-time work often works in the same way.

For some, a move to a different state can make a world of difference. This works if you live in a state with high taxes and high property values, and can move to a retirement tax-friendly state where you may be able to buy an equivalent home for less, freeing up home equity.

There are also options that involve reverse mortgages or annuities. These are viable strategies that, contrary to what many believe, can allow some to retire earlier, and often on more money.

7. Determine your level of engagement

Are you going to do your own planning and investment management, or hire someone to do it for you? Either way, you need to gain a basic understanding of how things change when you near retirement and what new risks you face. At a minimum, you need to know enough to recognize good advice from bad advice. I'd suggest you subscribe to publications particular to those near retirement.

Books are also a great resource. Many of my fellow RetireMentors are experts in their subject matter and have written outstanding books that you can learn from. You are also welcome to a free download of the first chapter of my book, Control Your Retirement Destiny .

If married, you also need to consider your spouse's level of engagement. You may be the money person, but how will your spouse fare when you are gone? It is cruel to leave an unsophisticated spouse to figure it out on their own. At a minimum do your research so you can tell them what kind of assistance they will need when you are gone, and how they can go about finding the appropriate resources.

Some of these steps may sound boring, and to be honest with you, sometimes they are. But the results they deliver — in terms of less stress and greater peace of mind — are anything but boring.

In the first season of "Friends," Rachel Green looks at her first paycheck as a waitress and asks, "Who's this FICA guy, and why is he getting all my money?"

In the first season of "Friends," Rachel Green looks at her first paycheck as a waitress and asks, "Who's this FICA guy, and why is he getting all my money?" There are many ways a married couple can decide to take their Social Security benefits, according to Alicia Munnell, director of the Center for Retirement Research at Boston College. You can't ask Social Security to list them all, so what's the right choice?

There are many ways a married couple can decide to take their Social Security benefits, according to Alicia Munnell, director of the Center for Retirement Research at Boston College. You can't ask Social Security to list them all, so what's the right choice? On the other hand, some people advocate drawing Social Security benefits at the first opportunity.

On the other hand, some people advocate drawing Social Security benefits at the first opportunity. If you're not happy in your marriage after 9 1/2 years, hold off before hiring a divorce attorney.

If you're not happy in your marriage after 9 1/2 years, hold off before hiring a divorce attorney. And we have another dirty little secret for you. If you haven't remarried, chances are your ex-spouse is worth more to you dead than alive -- especially if he or she was a high earner.

And we have another dirty little secret for you. If you haven't remarried, chances are your ex-spouse is worth more to you dead than alive -- especially if he or she was a high earner.  Social Security does a good job of explaining widow and widower benefits, but Dan Keady, director of financial planning for TIAA-CREF Financial Services, says it doesn't clearly spell out a key difference between widow/widower benefits and spousal benefits.

Social Security does a good job of explaining widow and widower benefits, but Dan Keady, director of financial planning for TIAA-CREF Financial Services, says it doesn't clearly spell out a key difference between widow/widower benefits and spousal benefits.

The Social Security website offers an explanation of how your benefits are calculated, but it's a little hard to follow. You can find a simpler explanation at MyRetirementPaycheck.org, a website sponsored by the National Endowment for Financial Education.

The Social Security website offers an explanation of how your benefits are calculated, but it's a little hard to follow. You can find a simpler explanation at MyRetirementPaycheck.org, a website sponsored by the National Endowment for Financial Education.